Abstract:You may have heard the terms "pips", "points", "pipettes" and "lots".

Arithmetic operations are performed here. only a little

You may have heard the terms “pips”, “points”, “pipettes” forex and “lots”. Now I will explain what it is and how to calculate its value.

Please take the time to study this material as it is very important for any Forex investor to understand. Dont think about buying or selling until you are familiar with pip values and profit and loss calculations.

What is a pip?

A “point” is a unit of measure used to describe the difference in value between two currencies. If EUR/USD increases from 1.1050 to 1.1051, a USD 1,0001 increase in value equals 1 pip. The pip is the last decimal point in the price quote. Most pairs are accurate to four decimal places, with rare exceptions, such as Japanese yen pairs (accurate to two decimal places). For example, EUR/USD is 0.0001 and USD/JPY is 0.01.

What is a pipette?

There are forex brokers that display currency pairs with a precision of “5 and 3” rather than “4 and 2” to decimal places. They often mean a fountain pipe known as a “dot” or “pipette”.

If the concept of “pip” does not cause enough confusion for novice Forex traders, consider the following: A “pip”, “pipette” or “decimal point” is equivalent to “tenths of a point”.

For example, if the GBP/USD exchange rate increases from 1.30542 to 1.30543, an increase of 0.00001 USD equals ONE PIPETTE.

On the trading platform, fractions are expressed as:

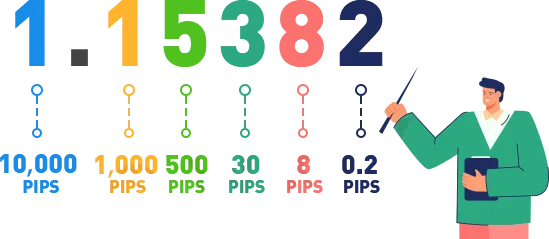

On buy and sell platforms, a number representing a tenth of a pip usually appears to be the correct of the two larger numbers. Here is a point “map” to help you find a way to learn points.

How to calculate pip value

Each currency has its own relative value, so you need to calculate the pip value for that currency pair. The following example uses quotation marks with four decimal places. To make the calculation easier to understand, we display the exchange rate as a percentage (for example, at 1.2500, the EUR/USD exchange rate is expressed as “1 Euro/1.2500 USD”). Example #1: CAD/USD = 1.0200

Multiply USD 1 to CAD 1.0200 (or USD 1 / CAD 1.0200) (the change in the value of the opposite currency) by the exchange rate factor. Same as pip value (default currency)

[0.0001CAD] Multiply [1 USD / 1.0200CAD]

or [(0.0001 CAD) / (1.0200 CAD)] × 1 USD = 0.00009804 USD per exchange unit.

If 10,000 units were sold in USD/CAD, a single tube fume hood with internal replacement filling could be a fume hood for $0.99 (10,000 units x $0.00009804 per unit). The value of each pip is called “roughly” because it fluctuates with the trading rate.

Example # 2: GBP / JPY = 123.00

Here's another example. This time there is a currency pair in which the Japanese Yen is used as the counter currency. It is worth noting that these currency pairs only provide two decimal places to represent a one-pip difference in value (most other currencies have four decimal places). There will be 1 point move in this situation. 01 yen

(the change in the value of the counterparty currency) multiplied by the exchange rate factor gives the value in pip (in the base currency).

[0.01 JPY] x [1 GBP / 123.00 JPY]

or [(0.01 JPY) / (123.00 JPY)] £ 1 x £ 1 = £ 0.0000813.

So, if you trade 10,000 units of GBP/JPY, each pip change is £0.813.

How to find the value of pip in the currency of your trading account

When calculating the pip price for a function, the last query it provides is “How much foreign currency is displayed in my Selling and Buying accounts?”

After all, this is a global market and not everyone is on the same Forex now. Therefore, the pip commission must be converted into the currency in which our account is traded. This is probably the most accurate estimate. Multiply or divide the “Setup Fee per Pip” by your foreign currency account and the conversion fee method for that foreign currency. If the “discovered value of pips” foreign exchange is similar to the bottom of the foreign exchange within the replacement fee estimate:

Using the GBP/JPY example above, let's convert a published GBP 813 pip price to a USD pip price with the option to use the 1.5590 GBP/USD conversion price ratio. If the foreign currency you want to convert is the relative currency of the conversion rate, you need to divide the “determined pip value” by the appropriate exchange rate factor.

£1/$1.5590 = £0.813 per pip

or $1.2674 x ($1.5590) per [(£0.813) / (£1)] step.

As a result, for every 1.0 pips shift in GBP/JPY, the value of 10,000 positions changes by approximately $1.27. If the currency you want to convert is the base currency of the exchange rate, multiply the “found pip value” by the exchange rate factor. Using the previous USD/CAD example, we want to calculate the pip value of $98 in New Zealand dollars. We use 7900 as the exchange rate factor.

Multiply by $0.98 per pip (1 NZD / $0.7900)

or [($0.98) / ($0.7900)] 1 NZD × 1 NZD = 1.2405 NZD in one step.

In the example above, the value of a 10,000 unit position changes by approximately NZ$1.24 per 0001 USD/CAD pips. Even if you're a math genius right now—at least when it comes to score values—you might close your eyes and think, “Do I really have to calculate all of this?”

The answer is an adamant NO. Almost all forex brokers do all this automatically, but it's always helpful to understand how they do it. If your broker doesn't, don't worry. Our pip value calculator can help! Aren't we fantastic? We'll talk about how this seemingly small amount can be increased in the next lesson.

Arithmetic operations are performed here. only a little

You may have heard the terms “pips”, “points”, “pipettes” forex and “lots”. Now I will explain what it is and how to calculate its value.

Please take the time to study this material as it is very important for any Forex investor to understand. Dont think about buying or selling until you are familiar with pip values and profit and loss calculations.

What is a pip?

A “point” is a unit of measure used to describe the difference in value between two currencies. If EUR/USD increases from 1.1050 to 1.1051, a USD 1,0001 increase in value equals 1 pip. The pip is the last decimal point in the price quote. Most pairs are accurate to four decimal places, with rare exceptions, such as Japanese yen pairs (accurate to two decimal places). For example, EUR/USD is 0.0001 and USD/JPY is 0.01.

What is a pipette?

There are forex brokers that display currency pairs with a precision of “5 and 3” rather than “4 and 2” to decimal places. They often mean a fountain pipe known as a “dot” or “pipette”.

If the concept of “pip” does not cause enough confusion for novice Forex traders, consider the following: A “pip”, “pipette” or “decimal point” is equivalent to “tenths of a point”.

For example, if the GBP/USD exchange rate increases from 1.30542 to 1.30543, an increase of 0.00001 USD equals ONE PIPETTE.

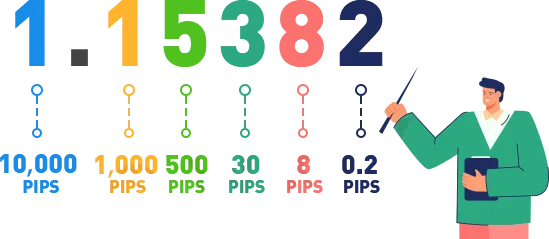

On the trading platform, fractions are expressed as:

On buy and sell platforms, a number representing a tenth of a pip usually appears to be the correct of the two larger numbers. Here is a point “map” to help you find a way to learn points.

How to calculate pip value

Each currency has its own relative value, so you need to calculate the pip value for that currency pair. The following example uses quotation marks with four decimal places. To make the calculation easier to understand, we display the exchange rate as a percentage (for example, at 1.2500, the EUR/USD exchange rate is expressed as “1 Euro/1.2500 USD”). Example #1: CAD/USD = 1.0200

Multiply USD 1 to CAD 1.0200 (or USD 1 / CAD 1.0200) (the change in the value of the opposite currency) by the exchange rate factor. Same as pip value (default currency)

[0.0001CAD] Multiply [1 USD / 1.0200CAD]

or [(0.0001 CAD) / (1.0200 CAD)] × 1 USD = 0.00009804 USD per exchange unit.

If 10,000 units were sold in USD/CAD, a single tube fume hood with internal replacement filling could be a fume hood for $0.99 (10,000 units x $0.00009804 per unit). The value of each pip is called “roughly” because it fluctuates with the trading rate.

Example # 2: GBP / JPY = 123.00

Here's another example. This time there is a currency pair in which the Japanese Yen is used as the counter currency. It is worth noting that these currency pairs only provide two decimal places to represent a one-pip difference in value (most other currencies have four decimal places). There will be 1 point move in this situation. 01 yen

(the change in the value of the counterparty currency) multiplied by the exchange rate factor gives the value in pip (in the base currency).

[0.01 JPY] x [1 GBP / 123.00 JPY]

or [(0.01 JPY) / (123.00 JPY)] £ 1 x £ 1 = £ 0.0000813.

So, if you trade 10,000 units of GBP/JPY, each pip change is £0.813.

How to find the value of pip in the currency of your trading account

When calculating the pip price for a function, the last query it provides is “How much foreign currency is displayed in my Selling and Buying accounts?”

After all, this is a global market and not everyone is on the same Forex now. Therefore, the pip commission must be converted into the currency in which our account is traded. This is probably the most accurate estimate. Multiply or divide the “Setup Fee per Pip” by your foreign currency account and the conversion fee method for that foreign currency. If the “discovered value of pips” foreign exchange is similar to the bottom of the foreign exchange within the replacement fee estimate:

Using the GBP/JPY example above, let's convert a published GBP 813 pip price to a USD pip price with the option to use the 1.5590 GBP/USD conversion price ratio. If the foreign currency you want to convert is the relative currency of the conversion rate, you need to divide the “determined pip value” by the appropriate exchange rate factor.

£1/$1.5590 = £0.813 per pip

or $1.2674 x ($1.5590) per [(£0.813) / (£1)] step.

As a result, for every 1.0 pips shift in GBP/JPY, the value of 10,000 positions changes by approximately $1.27. If the currency you want to convert is the base currency of the exchange rate, multiply the “found pip value” by the exchange rate factor. Using the previous USD/CAD example, we want to calculate the pip value of $98 in New Zealand dollars. We use 7900 as the exchange rate factor.

Multiply by $0.98 per pip (1 NZD / $0.7900)

or [($0.98) / ($0.7900)] 1 NZD × 1 NZD = 1.2405 NZD in one step.

In the example above, the value of a 10,000 unit position changes by approximately NZ$1.24 per 0001 USD/CAD pips. Even if you're a math genius right now—at least when it comes to score values—you might close your eyes and think, “Do I really have to calculate all of this?”

The answer is an adamant NO. Almost all forex brokers do all this automatically, but it's always helpful to understand how they do it. If your broker doesn't, don't worry. Our pip value calculator can help! Aren't we fantastic? We'll talk about how this seemingly small amount can be increased in the next lesson.